A lot more than you might think.

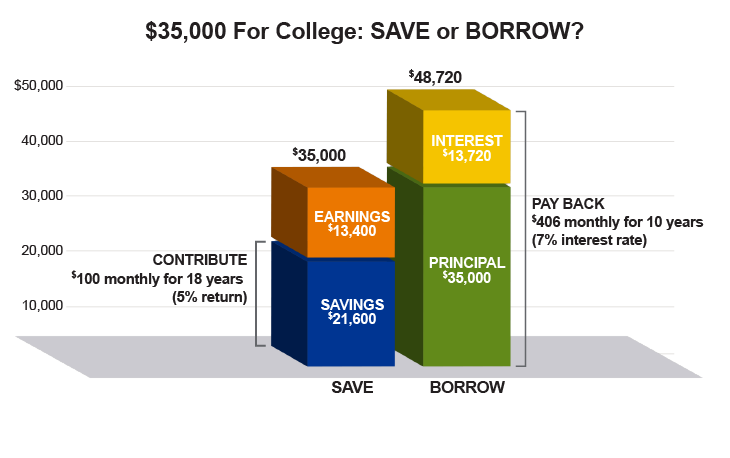

Saving even a small contribution each month costs much less than borrowing all of what you will need when the time comes. Consider these hypothetical scenarios:

Scenario 1: Terry's parents start investing $100 a month into a 529 plan account right after Terry's birth. In 18 years (assuming a 5% annual rate of return), they could potentially save more than $35,000.1

Scenario 2: After exhausting federal student aid options, Terry has to borrow $35,000 to attend college. Based on a private student loan rate of 7.0 percent, Terry could be faced with a monthly payment of $406 for 10 years (or $48,720).2

Then there are the effects you can not put a price on.

Paying back significant student loans can also impact graduates in places other than the wallet:

- 43% of student borrowers say that college debt has forced them to delay starting a family.3

- 42% say college loans cause them to put off major purchases, like a home or car.4

College education: A lifetime of value.

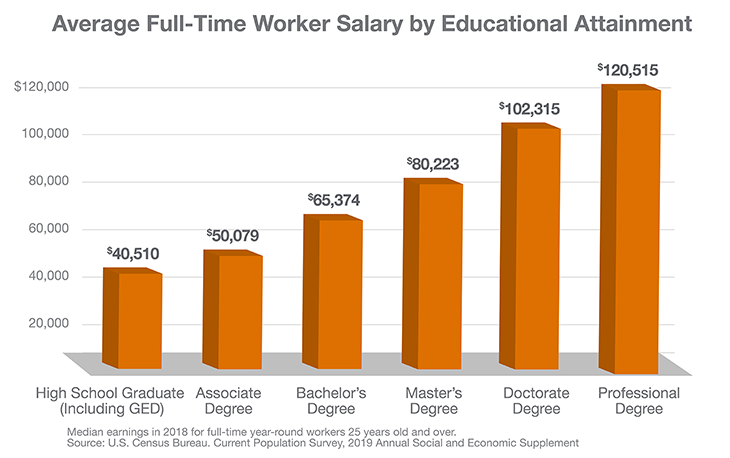

Bachelor’s degree recipients ages 25 to 34 had median earnings 63% ($19,550) higher than those in the same age range with high school diplomas in 2018.

The median family income for those with a Bachelor’s degree or higher earned 52% more than those with a high school education, and those with an Associate’s degree had median earnings that were 26% higher than the high school average.5

1A plan of regular investment cannot ensure a profit or protect against a loss in a declining market.

2This hypothetical example is for illustrative purposes only and assumes no distributions made during the period shown. It does not represent an actual investment in any particular 529 plan and does not reflect the effect of fees and expenses. Your actual investment return may be higher or lower than that shown. The loan repayment terms are also hypothetical.

3American Student Assistance, 2013.

4Study.com, The Student Debt Crisis, June 2015.

5College Board, Trends in College Pricing, 2019.