1. Higher education is still a great investment.

Is saving for education a sound investment? Absolutely! And the advantages go way beyond just higher income. Today, two-thirds of all job openings require postsecondary education, and college grads, on average, enjoy 57% more job opportunities than those with just a high school degree.1

2. 529 plans are an easy way to save a little at a time.

The DC College Savings Plan, like other 529 plans, helps make higher education more affordable. Families can save in small amounts over time, and as their children grow, their 529 savings could potentially grow free of state and federal taxes.4

3. Anyone can open a DC College Savings account.

Anyone5 - parents, grandparents, family friends – can open a 529 account for a loved one. There are no income limits, and anyone can contribute.

4. There is a lot more to higher education than just college – or tuition.

Use a 529 account to save for tuition, room & board, books, fees, computers and more at eligible colleges, universities, vocational schools and apprenticeship programs worldwide, not just in DC.6 You can even use it for K-12 tuition7 and to repay student loans.8

5. Saving in a DC College Savings Plan account can help you

save on your taxes.

That is because District taxpayers can receive a tax deduction up to $8,000 (up to $4,000, if filing individually) when they contribute to an account.9

6. 529s have minimal impact on financial aid.

No more than 5.64% of a 529 account balance is reported on the FAFSA when granting financial aid, provided the 529 is a parental asset.

7. 529 savings is not “use it or lose it.”

Things change. Life happens. With a DC College Savings Plan, you have options. Transfer an account’s balance to an immediate family member or yourself, or withdraw the money and pay tax on just the earnings portion and a 10% penalty.4

8. Making gifts to a 529 account is easy with Ugift®.

Do your kids really need another toy or teddy bear? Instead, ask friends and family to help save for their education at birthdays and holidays.

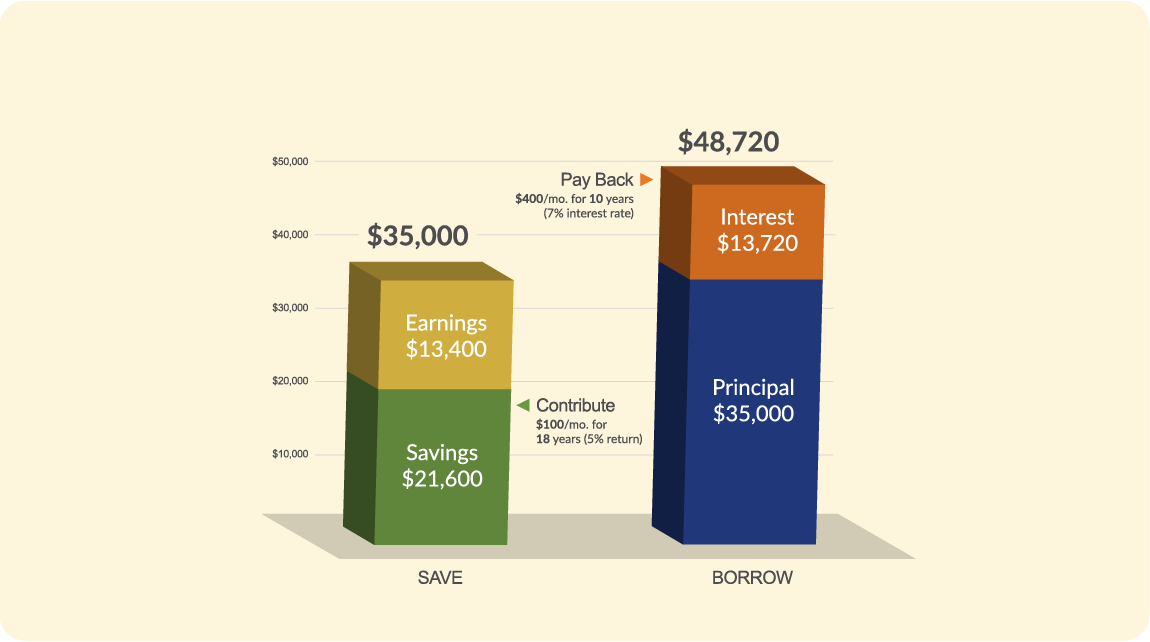

9. Every dollar saved means one less dollar you may have to

borrow and pay back with interest.

Saving for education beats borrowing for it every time, as the chart below shows:10

10. It only takes $25 and a few minutes to start.

Make every day work for your savings, starting today. Get started now.

Want to hear more about the DC College Savings Plan? Connect with us now

1 Georgetown University, Center on Education and the Workforce, America's Divided recovery, June 30, 2016.

2 US Census Bureau and US Bureau of Labor Statistics, Current Population Survey, March 2019 Supplement.

3 Pay gap between college grads and everyone else at a record, The Associated Press and the Economic Policy Institute, January 12, 2017.

4 Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes and recapture of DC tax deductions. Tax and other benefits are contingent on meeting other requirements and certain withdrawals are subject to federal, state, and local taxes.

5Any US citizen or resident alien, 18 or older, or an entity that is organized in the US, with a Social Security number and US street address, can open a DC College Savings Plan account, regardless of income level. Parents, grandparents, other family, and friends can open an account for anyone they choose.

6 An eligible institution is one that is eligible for federal financial aid programs.

7 Up to $10,000 per year, per student at any K-12 public, private, or religious school.

8 Student loan repayments: Principal or interest on any qualified education loan of the Beneficiary or a sibling of the Beneficiary, up to $10,000 lifetime, per individual. If you make an education loan repayment from your Account, you may not also take a federal income tax deduction for any interest included in that education loan repayment.

9 DC taxpayers who contribute to the DC College Savings Plan can deduct up to $4,000 in Plan contributions from their federal adjusted gross income each year on their DC tax return (up to $8,000 for married couples or domestic partners filing jointly if both own accounts).

10 This hypothetical example assumes college begins at age 18 and is based on a 5 percent rate of return compounded daily, and is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes payable upon withdrawal.